Seed Investing 101 - the Implications of Power Law Outcomes

Because seed investing outcomes follow a power law distribution, investors should have enough investments, underwrite for upside potential, participate in pro-rata, and establish a clear minimum bar to invest against.

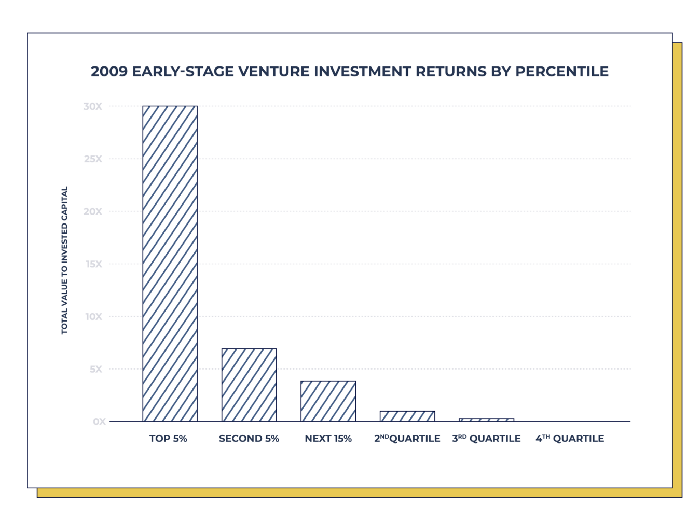

Early stage investing outcomes follow a power law distribution. The vast majority of investments break even or lose value, while a few massively outperform and are single handedly responsible for fund performance. Naspers made their name primarily on one single investment — $32M investment in Tencent in 2001 that is valued at $175Bn in March 2018 for a 5400x return. Such asymmetric outcomes means that seed investors should act differently than is traditionally understood:

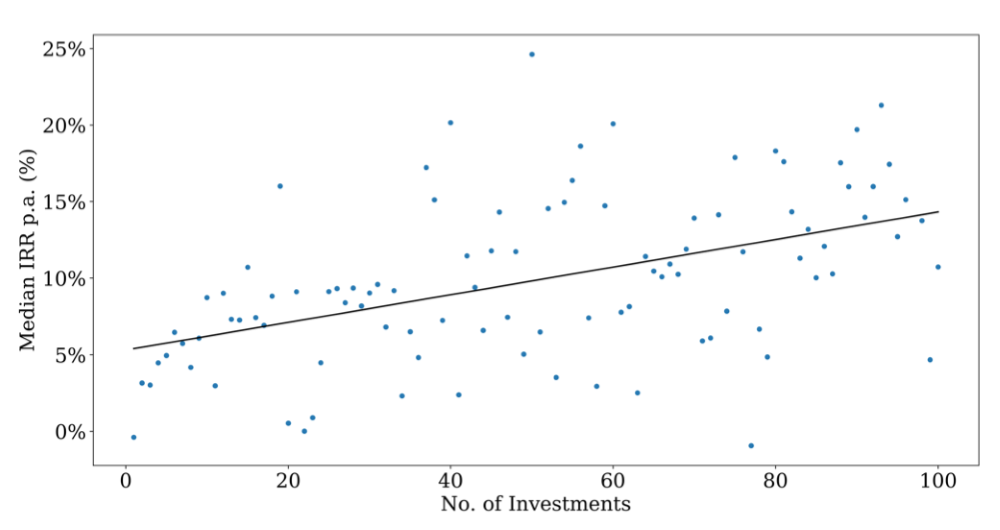

Make enough investments. Intuitively, this makes sense — because outcomes have a power law distribution, missing out on an outperformer is extremely costly. This is studied more qualitatively in the below links, which show that returns go up with the number of investments made. Seed/pre-seed investors should aim for a minimum of 20 shots on goal per 3-4 year interval.

Underwrite for upside potential. Because outcomes are asymmetric, and the majority of early stage companies fail, one should focus on finding companies that, if they become winners, are huge. Finding a 100x outcome with 9 other failures is a much better outcome than nailing 5 3x outcomes and 5 failures. This means venture investors should focus on asking how big a company could become if things go right, rather than what could go wrong.

Pro rata. Pro-rata rights, or the optionality to participate in the company's subsequent round(s) of funding, is essentially a call-option to gain additional ownership (or maintain ownership in the face of dilution) in the future, if the company does well. Obtaining these rights is especially important for pre-seed and seed investing, where a company's risk drastically reduces when a/ it achieves product market fit and b/ it has a growth engine where unit economics check out. The risk-adjusted expected return on the incremental dollar invested is often better once a/ and b/ as been achieved, especially if the startup's market is huge.

Establish a minimum bar. At first thought, this feels like a counterintuitive recommendation. Venture is all about exceptional outcomes — isn't investing against a baseline the antithesis of that? There are founder and company characteristics that drop the probability of a 100x outcome virtually to 0. For example, if one invests in a local restaurant, even if that restaurant is wildly successfully locally, one will likely not net a 100x return on capital within a 10 year time frame. The key is to filter those sets of deals out, leaving ones that have a low (but for venture, good) probability of a large upside. Sourcing, identifying and winning allocations in a sufficient number of deals that pass the bar is the bread and butter of venture investing.

Exceptions. This piece so far has been about exceptional companies. There are also exceptional venture investors (For example, Chris Sacca invested in Uber, Docker, Optimizely, Instagram, and Twitter out of his $8.4m Lowercase Ventures Fund, and had a whooping 216x multiple on invested capital by 2015. If one demonstrates consistent ability to hit unicorn outcomes the very early stages, then the calculus changes, and a concentrated approach might be better.

If you angel invest or have further thoughts, would love to hear from you! Hit me up on Twitter.

Thanks Earl Lee and Jeng Yang Chia for your feedback and comments!

Sources

- http://reactionwheel.net/2015/06/power-laws-in-venture.html

- https://whoisnnamdi.com/vcs-index-invest/amp/

- https://angel.co/pdf/lp-performance.pdf

- https://money.cnn.com/2018/07/30/investing/naspers-tencent-share-price/index.html

- https://avc.com/2014/03/the-pro-rata-participation-right/

- https://twitter.com/dunkhippo33/status/1243628603482357765